Roofing Tips & Guides

Expert Roofing Advice for Charlotte Homeowners

Learn from Charlotte's trusted roofing experts. Tips on maintenance, repair, replacement, and protecting your home from the elements.

Learn from Charlotte's trusted roofing experts. Tips on maintenance, repair, replacement, and protecting your home from the elements.

When you're staring at a $20,000 roofing estimate, that "lifetime warranty" sounds pretty tempting. But here's the thing – most homeowners don't understand what they're actually getting. After 15 years in the Charlotte roofing business, I've seen too many confused homeowners discover their "lifetime" warranty isn't what they thought it was.

Let me break down the real value of these warranties so you can make a smart decision for your home.

Here's where things get tricky. A lifetime roof warranty doesn't protect your roof for its actual lifespan. Instead, it covers the roof as long as you own your home. Once you sell, the original warranty coverage ends for you.

Think of it like a gym membership tied to your address. Great while you're there, but it doesn't follow you when you move.

This distinction matters more than you might think. The average American moves every 7-10 years. If you're planning to relocate within a decade, that "lifetime" warranty suddenly becomes a lot shorter.

But here's where it gets interesting – many lifetime warranties are transferable to new homeowners. This can actually boost your home's resale value and help it sell faster. We've seen buyers specifically choose homes with transferable roof warranties because it means one less major expense to worry about.

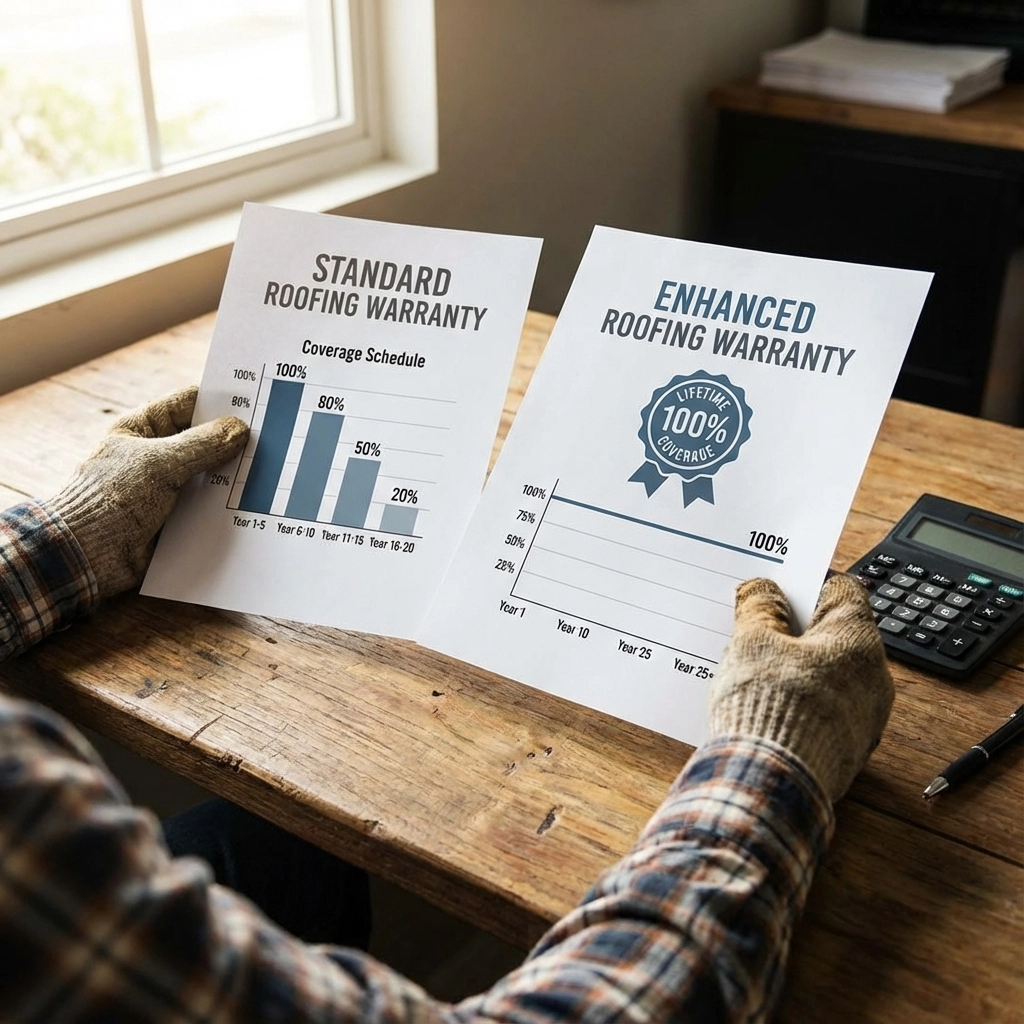

Not all lifetime warranties are created equal. There are two main types, and understanding the difference could save you thousands.

Standard Lifetime Warranties

Most manufacturers offer a basic lifetime warranty at no extra cost. Sounds great, right? Here's the catch – these warranties are prorated. Your coverage decreases every year.

For example, you might get 100% coverage for the first five years. By year eight, you're down to 90% coverage. By year 15, maybe you're only getting 70% coverage. And these standard warranties typically only cover the shingles themselves – not the underlayment, flashing, or other critical components.

Enhanced Warranties: The Game Changer

Enhanced warranties cost extra upfront, but they offer non-prorated coverage for 20-50 years. This means you get 100% coverage for the entire warranty period. No declining value. No surprises.

Better yet, enhanced warranties usually cover your entire roofing system. That includes underlayment, ice and water barriers, ridge vents, and even labor costs for repairs.

As one GAF representative told me, "The difference between our standard and enhanced warranties is like comparing basic car insurance to comprehensive coverage. Both will help, but one gives you real peace of mind."

Here's where reading the fine print becomes crucial. Standard warranties typically cover:

Enhanced warranties expand this to include:

But no warranty covers everything. Normal wear and tear, damage from falling trees, ice dams, or improper installation usually aren't included. And here in Charlotte, where we get intense summer storms, understanding wind coverage is particularly important.

Living in Charlotte means dealing with some serious weather challenges. We get everything from hurricane remnants to severe thunderstorms with damaging winds. Those beautiful summer storms can pack winds over 60 mph – enough to lift shingles and expose your roof deck.

Many enhanced warranties include wind coverage up to 120 mph. That's Miami-Dade hurricane standards applied to your Charlotte home. When you consider that a single storm can cause thousands in damage, this coverage becomes incredibly valuable.

I've worked on homes in Myers Park and Dilworth where storm damage would have cost homeowners $8,000-15,000 out of pocket. With enhanced warranty coverage, they paid nothing.

The key is choosing a warranty that matches our local climate challenges. A basic warranty might be fine in Arizona, but Charlotte homeowners need something more robust.

Enhanced warranties offer value beyond just roof repairs. Here's what I've observed over the years:

Increased Home Value

A transferable lifetime warranty can increase your home's value by 3-6%. In Charlotte's competitive market, that could mean an extra $10,000-20,000 on your sale price.

Faster Sales

Homes with transferable warranties tend to sell faster. Buyers love knowing they won't face a major roofing expense for decades.

Insurance Benefits

Some insurance companies offer discounts for homes with enhanced warranties and impact-resistant materials. It's worth asking your agent about potential savings.

Contractor Protection

Here's something most homeowners don't consider – what happens if your roofing contractor goes out of business? Enhanced warranties from manufacturers like GAF will honor the labor portion even if your original contractor disappears.

Enhanced warranties aren't right for everyone. They make the most sense if you:

Plan to stay put for 10+ years

The longer you stay, the more value you extract from non-prorated coverage.

Live in a high-wind area

Lake Norman, Huntersville, and areas near the Catawba River see stronger winds. Enhanced wind coverage pays off here.

Want maximum resale value

A transferable warranty is a strong selling point in Charlotte's competitive market.

Choose premium materials

If you're already investing in architectural shingles or metal roofing, enhanced warranty coverage protects that investment.

Standard warranties make sense if you:

Plan to move within 5-7 years

You'll get full coverage during the non-prorated period of most standard warranties.

Have budget constraints

Enhanced warranties can add $1,000-3,000 to your roofing project cost.

Live in a low-wind area

Some Charlotte neighborhoods are naturally sheltered from the worst weather.

Here's my simple formula for determining if an enhanced warranty is worth it:

Calculate the cost per year

Divide the warranty cost by the coverage period. A $2,000 warranty lasting 50 years costs $40 per year.

Consider your roof's replacement cost

On a $20,000 roof, even a 25% covered repair saves you $5,000.

Factor in your move timeline

If you're likely to move before year 10, focus on transferability value.

Assess local weather risks

Charlotte's storm frequency makes comprehensive coverage more valuable.

Not all warranty providers are created equal. Watch out for:

Unclear transferability terms

Some warranties claim to be transferable but have hidden restrictions.

Limited contractor networks

Make sure quality contractors in Charlotte can perform warranty work.

Prorated labor coverage

Even if materials are covered 100%, labor might still decrease over time.

Unrealistic wind ratings

Be skeptical of warranties claiming coverage for winds over 130 mph – that's tornado territory.

After helping hundreds of Charlotte homeowners navigate warranty decisions, here's my honest assessment:

Enhanced warranties are worth it for most homeowners planning to stay put for more than a decade. The non-prorated coverage, comprehensive system protection, and transferability benefits typically outweigh the upfront cost.

For a $2,000 investment on a $20,000 roof, you're getting decades of protection plus increased home value. That's solid math.

But don't get caught up in warranty marketing hype. The real value comes from choosing the right contractor and using quality materials. A great warranty on a poorly installed roof is worthless.

As building science expert Dr. Joseph Lstiburek notes, "A warranty is only as good as the installation behind it. Focus first on proper installation, then on warranty coverage."

The best approach? Work with certified contractors who offer enhanced manufacturer warranties. You'll get expert installation plus comprehensive long-term protection.

Here's what I tell every Charlotte homeowner considering warranty options:

Start with your timeline. If you're planning to stay in your home for 15+ years, enhanced coverage almost always pays off. If you might move within five years, focus on transferability and short-term value.

Consider your risk tolerance. Charlotte's weather can be unpredictable. Enhanced wind coverage provides real protection against our severe storms.

Think about your home's value. On higher-value homes in areas like Myers Park or Lake Norman, warranty transferability becomes a significant selling point.

Don't forget about labor costs. Material defects are relatively rare, but when they happen, labor costs often exceed material costs. Enhanced warranties covering both provide complete protection.

Choosing the right warranty is just one part of a successful roofing project. The foundation is working with experienced, certified contractors who understand Charlotte's unique challenges.

At Best Roofing Now, we're certified with major manufacturers to offer their top-tier warranty programs. We'll walk you through the real costs and benefits of each option – no sales pressure, just honest guidance based on your specific situation.

Ready to explore your warranty options? Schedule a free consultation and let's discuss what makes sense for your home and budget. We'll review your roof's condition, your long-term plans, and help you choose coverage that provides real value.

Your roof is one of your home's biggest investments. Make sure it's protected with warranty coverage that actually delivers when you need it most.

Best Roofing Now

Charlotte's trusted roofing experts since 2019

Need help with your roof? Explore our professional roofing services in Charlotte NC.

Get a free roof inspection and honest assessment from Charlotte's most trusted roofing company.