Roofing Tips & Guides

Expert Roofing Advice for Charlotte Homeowners

Learn from Charlotte's trusted roofing experts. Tips on maintenance, repair, replacement, and protecting your home from the elements.

Learn from Charlotte's trusted roofing experts. Tips on maintenance, repair, replacement, and protecting your home from the elements.

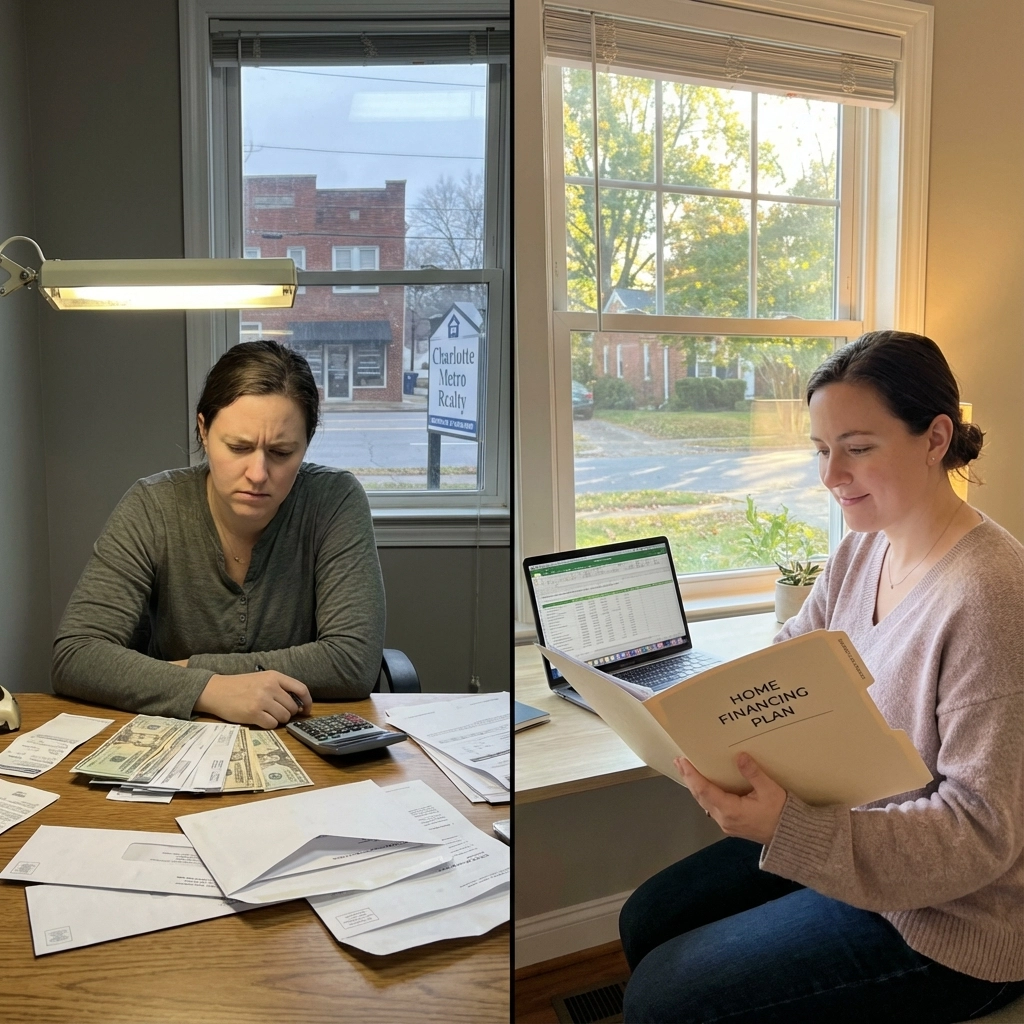

Your roof is leaking. The insurance adjuster just left. And now you're staring at a $15,000 estimate thinking, "Where am I supposed to get that kind of money?"

You're not alone. Most Charlotte homeowners don't have tens of thousands sitting in savings for a roof replacement. That's exactly why roof financing exists – and why it might be the smartest move you can make right now.

But should you finance your roof? The answer depends on your situation, your options, and how you weigh the pros and cons. Let me break it down for you.

You Keep Your Emergency Fund Intact

Here's the thing about using all your savings for a roof: what happens when your HVAC system dies next month? Or your car needs major repairs? Smart homeowners know that depleting your emergency fund for any single expense – even an important one – leaves you vulnerable.

Financing lets you spread the cost over time while keeping your financial safety net in place. That peace of mind is worth something.

You Can Act Fast When Time Matters

Charlotte weather doesn't wait for your savings account to grow. When Hurricane Helene damaged roofs across the area in September, homeowners who could move quickly got their repairs done before winter. Those who waited? They dealt with leaks, mold, and interior damage that cost way more than any financing interest.

Storm damage, aging shingles, and sudden leaks require immediate action. Financing removes the "wait and save" delay that often makes problems worse.

Your Home Value Goes Up Immediately

A new roof typically adds $12,000-$20,000 to your home's value in the Charlotte market. If you financed $15,000 but gained $18,000 in equity, you actually came out ahead – even with interest costs.

Plus, you'll see lower energy bills right away with modern materials and proper installation. Those monthly savings help offset your loan payment.

Interest Costs Add Up

This is the big one. If you finance $15,000 at 12% APR over 10 years, you'll pay about $21,600 total. That's $6,600 in interest – enough for a decent vacation or emergency fund boost.

Run the numbers on any financing offer. Sometimes paying cash (even if it hurts short-term) saves significant money long-term.

Monthly Payment Pressure

Adding $200-$300 to your monthly bills affects your budget flexibility. If you're already stretched thin, that payment could stress your finances for years.

Approval Isn't Guaranteed

Credit requirements vary, but most roof financing needs decent credit scores (usually 640+). If your credit is rough, you might face higher rates or get denied entirely.

Charlotte homeowners have several paths to finance a roof replacement. Here's what's actually available:

Contractor-Sponsored Financing

Most established roofers partner with financing companies like GreenSky, Wisetack, or Enhancify. These programs offer:

The catch? Interest rates after promotional periods can be steep (15-25% APR). These work best if you can pay off the balance during the 0% period.

Personal Loans Through Banks or Credit Unions

Local institutions like Piedmont Advantage Credit Union or Bank of America offer personal loans with potentially lower rates than contractor financing. Rates typically range from 6-18% APR depending on your credit.

Pros: Lower rates, direct control over funds

Cons: Separate application process, may take longer

Home Equity Line of Credit (HELOC)

If you have significant home equity, a HELOC often provides the cheapest financing. Rates are typically 6-10% APR, and interest may be tax-deductible.

Pros: Lowest rates, tax advantages, flexibility

Cons: Your home is collateral, requires equity, longer approval process

Insurance Claim + Financing Your Deductible

Many Charlotte homeowners don't realize they can finance just their insurance deductible. If insurance covers $12,000 of a $15,000 roof but you lack the $3,000 deductible, some contractors offer financing for that portion only.

Here's the typical process:

Step 1: Get Your Estimate

First, get a detailed roofing estimate. Reputable contractors provide written estimates with material specifications and labor costs. This becomes the basis for your financing amount.

Step 2: Apply for Financing

Most applications happen online or through your contractor's tablet. You'll need:

Step 3: Get Approved and Review Terms

Approval usually takes minutes for online lenders. Read the terms carefully – especially promotional interest rates, when they expire, and what the ongoing rate becomes.

Step 4: Work Begins

Funds typically go directly to the contractor, either upfront or upon completion. Your payments start based on the loan terms.

Let's look at real numbers for a typical $18,000 roof replacement:

Scenario 1: 0% Financing for 18 Months

Scenario 2: 10-Year Loan at 12% APR

Scenario 3: HELOC at 7% APR, 10 Years

Time Your Application Right

Apply for financing after you've chosen your contractor but before work starts. This gives you negotiating power and ensures funding is ready.

Read the Fine Print on Promotional Rates

That 0% rate usually jumps to 20%+ after the promotional period. If you can't pay it off in time, factor the higher rate into your decision.

Consider Your Local Weather Timeline

Charlotte's storm season (June-November) creates high demand for roofers. Financing approved in advance lets you book quality contractors faster during busy periods.

Don't Finance More Than You Need

Some programs offer credit lines up to $55,000. Just because you qualify doesn't mean you should use it all. Stick to your actual roofing needs.

Compare Multiple Options

Your contractor's preferred lender might not offer the best terms for your situation. Shop around, especially if you have good credit.

Sometimes financing isn't the right move:

Ask yourself these questions:

If you answer yes to urgency and value questions, while answering no to budget stress concerns, financing probably makes sense.

Living in Charlotte gives you access to competitive financing markets and numerous qualified contractors. The strong local economy and growing housing market also mean your roof investment has solid backing.

Plus, Charlotte's weather patterns make delaying roof work risky. Our sudden storms and temperature swings can turn minor issues into major problems quickly.

Every Charlotte homeowner's situation is unique. The right financing option depends on your credit, budget, timeline, and the urgency of your roof needs.

If you're dealing with a roof that needs attention, don't let financing concerns delay your decision. The cost of waiting often exceeds the cost of interest.

Ready to explore your options? Contact Best Roofing Now for a free inspection and detailed estimate. We'll walk you through financing options that fit your budget and get your roof protection back on track. Call (704) 605-6047 or visit our website to schedule your consultation today.

Your roof protects everything underneath it. Make sure financing helps rather than hinders that protection.

Best Roofing Now

Charlotte's trusted roofing experts since 2019

Need help with your roof? Explore our professional roofing services in Charlotte NC.

Get a free roof inspection and honest assessment from Charlotte's most trusted roofing company.