When storm damage hits your Charlotte home, you're already dealing with stress and unexpected expenses. So when a contractor knocks on your door offering to "waive your deductible" and handle everything with your insurance company, it might sound like a dream come true. But here's the reality: waiving your deductible is one of the riskiest decisions you can make as a homeowner.

Let's break down exactly why this seemingly generous offer can turn into your worst nightmare.

The Legal Reality: It's Actually Insurance Fraud

Here's something that might shock you: in North Carolina and most other states, waiving your deductible is illegal. It's classified as insurance fraud, and both you and the contractor can face serious legal consequences.

When contractors offer to waive your deductible, they don't actually eat the cost. Instead, they inflate the repair estimate to cover your deductible amount, essentially billing your insurance company for work that costs more than it should. This is fraudulent billing, plain and simple.

The National Insurance Crime Bureau actively investigates these cases, and the penalties are severe. You could face:

- Fines ranging from hundreds to thousands of dollars

- Misdemeanor or felony charges depending on the amount involved

- A permanent mark on your criminal record

- Difficulty obtaining future insurance coverage

"Insurance fraud costs all consumers money through higher premiums," says the North Carolina Department of Insurance. "When contractors inflate claims to cover deductibles, everyone pays the price."

Even if you didn't know it was illegal, ignorance isn't a defense in court. The moment you sign that contract agreeing to a waived deductible, you're potentially participating in insurance fraud.

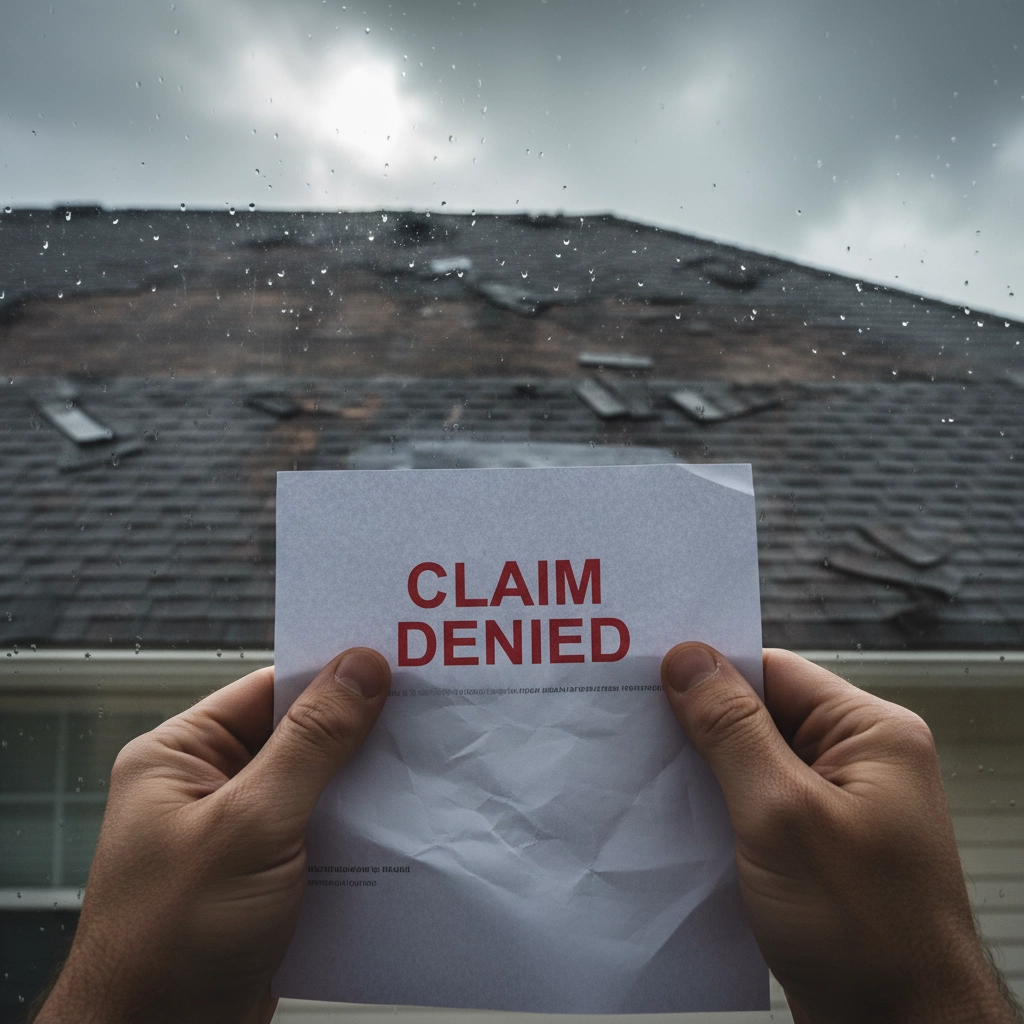

Your Insurance Coverage Is at Risk

Beyond the legal issues, waiving your deductible puts your insurance coverage in serious jeopardy. Insurance companies have entire departments dedicated to identifying fraudulent claims, and they're getting better at catching these schemes every year.

Voided Claims and Denied Coverage

When your insurance company discovers inflated charges or evidence of deductible waiver arrangements, they can:

- Deny your current claim entirely, leaving you responsible for all repair costs

- Void your policy for breach of contract

- Cancel your coverage, making it extremely difficult to find new insurance

- Flag you in industry databases, affecting your ability to get coverage elsewhere

Premium Increases and Policy Cancellations

Even if your claim isn't initially flagged, insurance companies conduct regular audits. If they discover deductible waiver arrangements months or even years later, you could face:

- Immediate policy cancellation

- Demands for refund of all payments made on fraudulent claims

- Significantly higher premiums with future insurers

- Difficulty obtaining coverage at any price

The Charlotte area sees plenty of storm damage, and insurance companies are particularly vigilant about roofing claims. They know the common tricks contractors use, and they're not hesitant to investigate suspicious billing patterns.

Quality and Safety: You Get What You Don't Pay For

When contractors offer to waive your deductible, that money has to come from somewhere. And unfortunately, it usually comes out of the quality of your repairs.

Substandard Materials and Workmanship

Contractors who waive deductibles often cut corners by:

- Using cheaper, lower-grade materials

- Rushing through the work to save on labor costs

- Skipping important steps in the repair process

- Hiring less experienced workers

- Reducing the scope of work to save money

For roofing specifically, this might mean:

- Using thinner shingles that won't last as long

- Skipping proper flashing installation around chimneys and vents

- Not properly sealing penetrations

- Inadequate ventilation installation

- Poor cleanup, leaving nails and debris that can damage tires or injure family members

Voided Warranties

Quality manufacturers stand behind their products with comprehensive warranties. But when contractors use substandard installation practices to save money, these warranties become void. You lose protection from:

- Manufacturer defects

- Premature material failure

- Installation-related problems

- Weather damage due to improper installation

This means if something goes wrong with your roof in a few years, you're on your own for the repair costs. That "free" deductible waiver could end up costing you thousands more than you saved.

The True Financial Cost

While waiving a deductible saves you money upfront, it almost always costs significantly more in the long run. Here's the math that contractors hoping you won't do:

Immediate Hidden Costs

- Your insurance company pays inflated amounts, driving up everyone's premiums

- You may lose negotiating power if additional work is needed

- Emergency repairs might be necessary if the initial work fails

- You might need to hire another contractor to fix poor workmanship

Long-Term Financial Impact

Consider a typical Charlotte homeowner with a $1,000 deductible who accepts a waiver:

- The contractor inflates the claim by $1,000 to cover the deductible

- Poor quality work leads to premature failure in 5-7 years instead of the expected 15-20

- A full roof replacement costs $15,000-$25,000

- The homeowner pays the full amount since it's now considered normal wear and tear, not storm damage

- Total cost: $15,000-$25,000 versus the original $1,000 deductible

The math is clear: that $1,000 savings can easily turn into a $20,000+ loss.

Red Flags: Spotting Deductible Waiver Schemes

Protecting yourself starts with recognizing the warning signs of contractors who engage in these practices:

Door-to-Door Solicitation

Legitimate contractors don't typically go door-to-door offering to waive deductibles, especially right after storms.

Pressure Tactics

"Sign today or lose this deal" is a classic red flag. Reputable contractors give you time to make informed decisions.

Upfront Payment Requests

Contractors asking for payment before work begins, especially full payment, are often running scams.

No Local Address

Storm chasers often work out of hotels or have out-of-state addresses. Local contractors have established reputations to protect.

Too-Good-To-Be-True Offers

Beyond deductible waivers, be wary of offers for "free" inspections, upgrades, or additional work that isn't covered by insurance.

Working with Legitimate Contractors

Reputable roofing contractors in Charlotte follow ethical practices and comply with insurance laws. They understand that:

- Deductibles exist for good reasons

- Quality work requires fair compensation

- Long-term customer relationships matter more than quick profits

- Proper insurance processes protect everyone involved

When choosing a contractor, look for:

- Proper licensing and insurance

- Local references and established reputation

- Clear, detailed contracts

- Reasonable timelines and realistic pricing

- Willingness to work with your insurance adjuster appropriately

The Bottom Line

Your deductible isn't just a fee – it's your investment in quality work, legal compliance, and long-term protection. While paying a $500, $1,000, or even $2,500 deductible might sting initially, it's infinitely better than facing insurance fraud charges, voided coverage, or having to replace your entire roof years earlier than necessary.

At Best Roofing Now, we understand that storm damage is stressful enough without worrying about legal and financial complications. We work transparently with insurance companies, provide honest estimates, and never pressure homeowners into questionable arrangements. Our goal is to restore your roof properly the first time, using quality materials and proven techniques that will protect your Charlotte home for decades to come.

Remember: if a deal sounds too good to be true, it usually is. Protect yourself, your family, and your home by working with contractors who respect both you and the law. Your future self will thank you for making the smart choice today.

Want to learn more about working with insurance companies after storm damage? Visit our services page or check out our other helpful resources in our blog section.